Have you ever found something you wanted to buy, but your payday was still a few days away? Maybe a new jacket or a small kitchen item? Most of us have. That’s where Payflex helps.

Payflex is a simple payment tool that lets you buy something today and pay for it later. You don’t need a credit card or big savings. Instead, Payflex breaks your payment into four small, interest-free parts.

In this article, you’ll learn:

- How Payflex works

- Who can use it

- Where you can use it

- The pros and cons

- And whether it’s a good choice for you

How Does Payflex Work?

Pay in Four Simple Steps

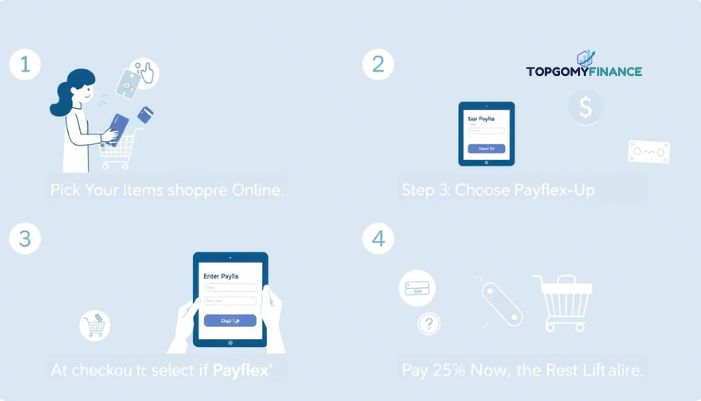

Payflex makes shopping easy. Here’s how it works:

- Pick Your Items

Go to an online store that uses Payflex. Add things to your cart, just like normal. - Choose Payflex at Checkout

When it’s time to pay, pick Payflex instead of a card or EFT. - Quick Sign-Up

Enter your name, ID number, email, and card details. You’ll know within seconds if you’re approved. - Pay 25% Now, the Rest Later

You pay only 25% today. The rest is paid in three parts—every two weeks.

Here’s an example:

If you buy something for R1,000, you pay R250 now, and then R250 every two weeks. Easy and stress-free!

Who Can Use Payflex?

Shoppers

To use Payflex, you need:

- To live in South Africa

- Be 18 years or older

- A valid South African ID

- A debit or credit card

- A working mobile number and email

That’s it! You don’t need a perfect credit score or long forms.

Business Owners

Own a store? Payflex can help your business grow. When you add Payflex, your shoppers get more freedom to buy. That means you may see:

- Higher sales

- Bigger carts

- More happy customers

Why Is Payflex So Popular?

People Love Flexibility

Paying over time helps people stick to their budgets. Let’s say you need to buy school clothes, groceries, and a phone this month. With Payflex, you don’t need to pay for everything at once. You can spread the cost and still get what you need right away.

Interest-Free Shopping

If you pay on time, there’s no interest—ever. You pay the same price as you would upfront. This makes Payflex a great option compared to credit cards, which charge high interest.

Simple and Fast

Payflex is quick to set up. You don’t have to call anyone or wait days to be approved. Most people are accepted right away.

Where Can You Use Payflex?

Payflex is accepted at thousands of online stores across South Africa. You can buy clothing, beauty items, electronics, gifts, and more.

Here are some popular stores that accept Payflex:

- Cotton On

- Superbalist

- Bash

- Typo

- Volpes

- And hundreds of local shops too

More stores are adding Payflex every month.

Read: Old Navy Credit Card: Perks, Drawbacks & Smart Tips in 2025

Is Payflex Safe?

Yes, it’s very safe. Payflex uses top-level security tools to protect your info. It does not share your data with stores or other companies.

Payflex follows all South African financial rules. Your payments are processed using secure systems, just like with banks.

Payflex vs Credit Cards vs Layby

Let’s compare Payflex with other payment types:

| Payment Type | Interest? | Get Items Now? | Late Fees? |

|---|---|---|---|

| Payflex | No | Yes | Low |

| Credit Card | Yes | Yes | High |

| Layby | No | No | None |

So, What’s Best?

- Payflex is great if you want something now but want to pay later without interest.

- Credit cards are fast but charge interest if you don’t pay quickly.

- Layby is safe, but you wait until it’s fully paid before getting your item.

Are There Any Downsides?

Payflex works well, but it’s not perfect. Let’s look at the cons.

You Could Overspend

Because it’s easy to pay later, you might spend more than you planned. Always ask: Can I really afford this over the next six weeks?

Late Payments Cost Money

If you miss a payment, Payflex charges a small fee (R65). If you keep missing, the max fee is R195. That’s still less than a credit card, but it’s best to stay on track.

Not Everyone Gets Approved

Payflex checks your payment history. If you owe money or don’t follow rules, they may not approve your next purchase.

Is Payflex Good for Online Stores?

Yes—Here’s Why

If you run a business, Payflex can help boost your sales. Shoppers are more likely to finish a purchase if they can pay in parts. Businesses often see:

- More orders

- Bigger carts

- Fewer people leaving the checkout page

Fast Setup

It’s easy to connect Payflex with your store—especially if you use platforms like Shopify or WooCommerce.

Get Paid Upfront

You don’t have to wait for customers to finish all four payments. Payflex pays you almost right away (minus their small fee). That’s great for your cash flow.

Final Thoughts

Payflex is not a loan. It’s not credit either. It’s a simple way to pay for things over time, without paying extra. It works well for shoppers who want more freedom and for stores that want to sell more.

But it’s important to be smart. Only buy what you can afford to pay off. Stay on top of your payment plan. If you do that, Payflex can be a helpful tool—not just for your wallet, but for your peace of mind.