Have you ever heard of a simple rule for managing money? It’s called the 50/30/20 rule. According to this rule, 50% of your income should go to needs (essential expenses), 30% to wants (non-essential or lifestyle spending), and 20% to savings and debt repayment. Many people struggle to keep track of these calculations properly. That’s why we want to show you how you can create your first budget using Gomyfinance.com. When you start budgeting, you begin developing real financial skills. You’ll understand where your money is going, be able to set clear goals, and feel more confident in your money decisions.

1. Create an Account

Go to the official website GoMyFinance.com and sign up using your Email, Google, or Apple account. After verifying your email, you’ll be taken directly to your personal dashboard. From here, you can quickly and easily start building your budget. GoMyFinance helps you save time by giving you a tailored budgeting tool that fits your lifestyle and goals. So don’t wait—create your account now and begin your budgeting journey with a fresh experience.

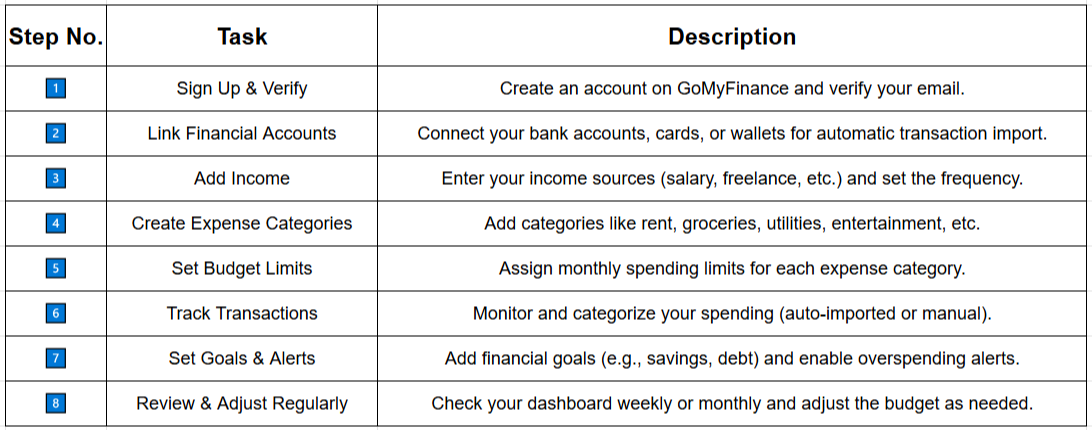

Steps:

Visit GoMyFinance.com

Sign up using Email, Google, or Apple

Verify your email and access the dashboard

2. Link Your Bank or Financial Accounts (Optional)

If you want to automate your budgeting process, you can link your bank accounts, credit cards, or other financial accounts. This will allow GoMyFinance to automatically track your expenses and help build an accurate budget. However, this step is optional. If you prefer, you can manually enter your income and expenses.

3. Add Your Income

Manually input all your income sources like salary, business earnings, freelance work, etc. Enter your monthly income as this will serve as the foundation for creating your budget.

Myfastbroker .com: Fastest and Easy Trading Platform in 2025

4. Add Your Expenses

Carefully list all your expenses, such as:

- Fixed costs: Rent, electricity bills, insurance, subscriptions, medication, etc.

- Variable costs: Shopping, entertainment, dining, travel, etc.

Add these under proper categories so you can track and manage your expenses better.

5. Choose or Customize a Budget Plan

GoMyFinance offers ready-made templates for individuals, families, and students—making it easy for everyone to get started. You can also customize your own plan.

You may follow the 50/30/20 rule:

- 50% for Needs – Essentials like housing, food, bills

- 30% for Wants – Non-essentials like entertainment, travel

- 20% for Savings – Emergency fund, investments, future planning

6. Set Financial Goals

Set clear goals like:

- Travel fund

- Emergency fund

- Loan repayment

Assign a target amount and a timeline for each goal. GoMyFinance will automatically calculate how much you need to save each day or month to reach your goal—so you can focus on your life without worrying constantly.

7. Track and Update Regularly

From your dashboard, you can see graphs and charts to understand where your money is going. If you exceed your budget, you’ll get notifications directly on your phone.

Check your budget at least once a month and make necessary updates. This makes it easier to stay on track.

8. Use Extra Features (Optional but Helpful)

- Set up Auto-saving to make saving effortless

- Spending Analysis to identify patterns

- Invite family or partners to manage a shared budget

Quick Summary Table (Banglish Version)