If you rent your home or apartment, this guide is for you.

You may think you do not need insurance. You may think your landlord will fix or replace things if something bad happens. That is not true. The landlord only covers the building. You must protect your own things.

This is where renters insurance helps.

MyWebInsurance.com gives you an easy way to buy renters insurance online. It only takes a few minutes.

What Is Renters Insurance?

Renters insurance helps you in three big ways:

- It pays for your stuff if it gets stolen or damaged.

- It helps if someone gets hurt in your home and blames you.

- It pays for a hotel if your place gets damaged and you cannot live there.

It is like a safety net. It protects your money, your things, and your peace of mind.

What Does MyWebInsurance.com Renters Insurance Cover?

Here is what the plan can cover:

1. Your Stuff (Personal Property)

This means all the things you own. That includes:

- Clothes

- Furniture

- TV

- Phone

- Computer

- Kitchen items

- Books

- Bikes

If someone steals your TV or a fire burns your couch, renters insurance pays to replace it.

2. Liability

If someone gets hurt in your home, this helps. For example, if your friend slips and falls, you may have to pay their medical bills. Insurance helps cover that.

It also helps if you damage someone else’s stuff. If water from your sink floods your neighbor’s place, you may need to pay. Renters insurance helps with that too.

3. Living Elsewhere (Loss of Use)

If your home is not safe to live in, insurance pays for a hotel or other place to stay. It also pays for extra food costs or travel if needed.

4. Medical Payments

If a guest gets hurt and needs to see a doctor, renters insurance may pay the bill. This happens even if they do not blame you.

What Does It Not Cover?

It does not cover everything. Here are some things renters insurance does not cover:

- Floods from heavy rain or storms

- Earthquakes

- Pests like mice or bugs

- Your roommate’s stuff (unless named in the policy)

Check your policy to see what is not included.

How Much Does It Cost?

Renters insurance from MyWebInsurance.com is not expensive. Most people pay $10 to $25 per month.

The price depends on:

- Where you live

- How much coverage you want

- Your credit history

- Your past insurance claims

- Your deductible (how much you pay before insurance helps)

You can pick a plan that fits your budget.

Why Do You Need It?

If you rent, you should have renters insurance. Here is why:

- Theft: If someone steals your laptop, insurance pays to replace it.

- Fire: If a fire burns your things, you do not lose everything.

- Accidents: If someone trips in your home and gets hurt, you do not pay alone.

- Landlords do not cover your stuff: Their insurance only protects the building.

Also, many landlords now require renters insurance before you move in.

How To Get Renters Insurance from MyWebInsurance.com

It is easy. You can do it online in less than 10 minutes. No calls. No paperwork.

Just follow these steps:

- Go to MyWebInsurance.com

- Type in your ZIP code

- Answer a few questions (where you live, how much your stuff is worth)

- Pick your plan

- Pay online

You will get your policy right away.

What Makes MyWebInsurance.com Different?

Many insurance sites are hard to understand. MyWebInsurance.com keeps it simple.

- No confusing words

- No phone calls unless you want to talk

- Easy online signup

- You control your policy in your online account

You can also file claims online 24/7.

When Should You File a Claim?

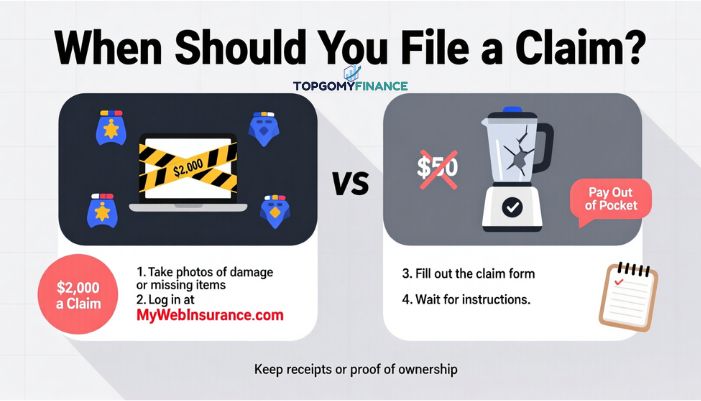

If your loss is big, file a claim. If the cost is low, you may choose to pay out of pocket.

For example:

- A stolen $2,000 laptop? File a claim.

- A broken $50 blender? It might not be worth it.

When you file a claim:

- Take pictures of the damage or missing items

- Log into your account at MyWebInsurance.com

- Fill out the claim form

- Wait for next steps

You may need to show proof of what you owned.

How Much Coverage Should You Choose?

Make a list of what you own. Add up the value. Include:

- Electronics

- Clothes

- Furniture

- Jewelry

- Kitchen items

Use this number to pick the right plan.

Also, check your lease. Some landlords want you to have a certain amount of liability coverage.

Read: Simply Business: Full Breakdown for Small Business Owners in 2025

Can You Add a Roommate?

Yes. But only if both of you agree. You must both be on the same policy. Keep in mind:

- Claims from your roommate affect you too

- If you want to stay separate, get your own policy

What About Pets?

If your dog or cat hurts someone, renters insurance might help. But not all pets are covered. Some dog breeds may not be allowed.

Read your policy or ask for help if you are not sure.

Mistakes to Avoid

- Not reading the policy: You must know what is covered.

- Choosing too high a deductible: A low monthly cost may mean you pay more when you file a claim.

- Not updating your policy: If you move or buy new things, update your plan.

Conclusion

Renters insurance is not just helpful. It is smart. It protects your things and your money. For a low monthly price, you get real peace of mind.

MyWebInsurance.com makes it easy. No long forms. No hard words. No stress. Just fast, simple coverage.