Health insurance can be hard to understand. Many people get confused when they try to sign up. mywebinsurance.com helps make the process easier.

If you need health insurance, this site can help you compare plans, apply online, and get coverage. You don’t have to call anyone or leave your house.

Here’s a simple and clear guide to help you understand how it works.

What is mywebinsurance.com?

mywebinsurance.com is a website. It helps people find health insurance.

It works like a store. You look at different plans and pick the one that fits your needs.

You don’t get insurance from this website. The insurance comes from the company you choose.

The site just helps you find it.

Who Should Use This Site?

You should check this site if:

- You don’t get health insurance from your job

- You work for yourself

- You want to see more plans

- You missed open enrollment

- You want short-term health coverage

This site is good for people who need help picking a plan.

How Does the Site Work?

Here’s what you do:

- Go to mywebinsurance.com

- Type in your age, zip code, income, and family size

- Look at the health plans

- Compare prices and benefits

- Pick a plan and apply online

- Get approved and start your coverage

You can do all of this in one visit if you have your info ready.

What Kind of Plans Can You Find?

You will see different types of health plans. The plans depend on where you live and what you need.

1. ACA Plans (Affordable Care Act)

These plans follow the law. They cover:

- Doctor visits

- Emergency care

- Medicine

- Mental health

- Pregnancy care

They also cover people with preexisting conditions.

If you make less money, you may get help paying for the plan.

2. Short-Term Plans

These plans are for a short time. You may want one if:

- You’re between jobs

- You missed the deadline

- You need fast coverage

But be careful. Many short-term plans do not cover checkups or long-term illness.

3. Extra Coverage

You may also see other plans like:

- Dental

- Vision

- Accident insurance

- Critical illness plans

These help with extra costs. But they are not full health insurance.

How Much Do the Plans Cost?

The price depends on many things:

- Your age

- Where you live

- What type of plan you pick

- If you get help paying for it

Some plans cost less than $100 each month. Others can cost more.

But don’t just look at the monthly price. Look at what you must pay if you get sick.

Check:

- The deductible

- The copay

- What the plan does not cover

A cheap plan can cost more later if you get hurt or sick.

Read: MyWebInsurance.com Renters Insurance: A Simple Guide for Renters

Is the Site Safe?

The site uses basic safety tools to protect your data.

But when you enter your info, it may be shared with insurance agents. You might get calls or emails after that.

If you don’t want that, look for a way to stop those messages.

Also, make sure you know which company is giving you the plan. You need to know who you are buying from.

Pros of Using mywebinsurance.com

- It’s easy to use

- You can see many plans in one place

- You can apply online

- You get fast results

Cons to Watch Out For

- You may get sales calls or emails

- Some plans don’t cover enough care

- Not all plans follow ACA rules

- Not every insurance company is listed

Always read the details of each plan before you choose.

Mistakes People Make

Many people choose the cheapest plan. That can be a big mistake.

Cheap plans may:

- Not cover your doctor

- Not pay for medicine

- Have high deductibles

Here’s what you should always check:

- What the plan covers

- What it does not cover

- If your doctor is in the plan

- How much you pay when you’re sick

Take your time. Ask questions. Be sure the plan works for your needs.

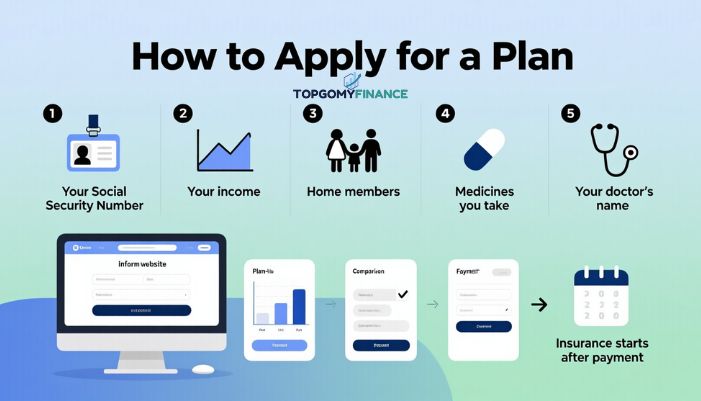

How to Apply for a Plan

Get this info ready before you start:

- Your Social Security Number

- Your income

- How many people are in your home

- Any medicines you take

- Your doctor’s name

Then:

- Go to the website

- Fill in your info

- Compare the plans

- Pick the one you want

- Finish the form

- Make your first payment

Your insurance starts after that.

What Happens Next?

After you sign up:

- The company sends your ID card

- You get a welcome letter

- You pay your first bill

- Your coverage starts on the date shown in your plan

Don’t miss your first payment. If you do, your plan may not start.

Should You Use This Site?

Yes, if you want to:

- See different plans

- Apply online

- Save time

But make sure to read every plan. Look past the monthly price. Think about what you need.

Ask yourself:

- Will this plan cover the care I use?

- Can I afford the deductible?

- Will my doctor take this plan?

If you say yes to all three, then it may be a good choice.

Final Thoughts

mywebinsurance.com can help you find a health plan. It’s fast. It’s easy. You can do it from home.

But don’t rush. Health insurance is important.

Look at the full plan. Not just the cost. Check the doctors, the services, and the extra fees.

If you don’t understand something, ask. It’s better to ask now than to find out later that something is not covered.

Health insurance should help you, not confuse you. Take your time. Choose what’s right for you.

FAQs

Is mywebinsurance.com a real site?

Yes. It’s a real website that shows health insurance plans.

Does it offer government plans?

It may list ACA plans, but it is not a government site.

Can I get Medicare or Medicaid here?

No. For that, go to the official Medicare or Medicaid site.

Will I get sales calls after using the site?

Maybe. Your info may go to agents. You can ask to stop the messages.

Do I have to pay to use the site?

No. You can use the site for free. You only pay for the plan you choose.

What if I make a mistake?

Call the insurance company. Fix it right away.