If you need a loan, you want to know where you stand. Many sites use credit scores to decide if you can borrow. traceloans com does this too, but in a new way.

This score looks at more than just your credit report. It also looks at how you spend, save, and repay. That gives you a full view of your money habits.

You can check your score for free. You can also see tips to raise it. This helps you learn and grow as a borrower.

Let’s break down how it works and what it means for you.

What is traceloans com?

traceloans com is a website that connects people to lenders. It is not a bank. It does not give loans directly. Instead, it helps you find offers from loan companies.

The site also gives you your own credit score. This score is called the TraceScore. It shows how likely you are to repay a loan on time.

Unlike other scores, the TraceScore changes often. It updates when your money habits change. This helps you see how your actions affect your score right away.

How the traceloans com credit score works

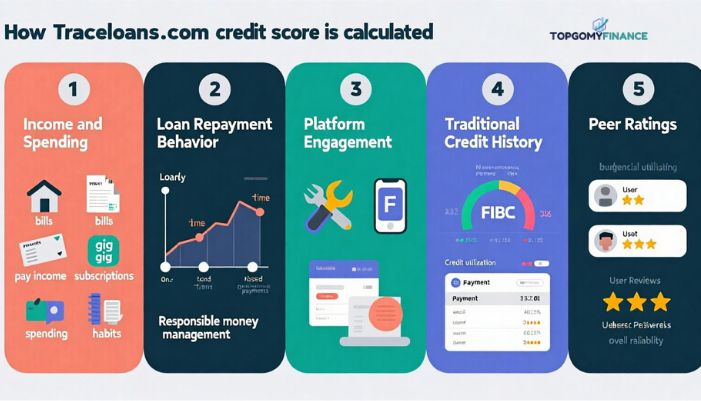

This score is not based only on your credit report. It looks at other things too. Here are the main parts:

1. Your income and spending

The site checks how much money you make and how you use it. It looks at:

- Rent and bills

- Paychecks or gig income

- Subscriptions and spending habits

If you earn steady income and manage money well, your score goes up.

2. How you pay back loans

If you take a loan through traceloans com, they watch how you repay. On-time payments help your score. Missed payments hurt it.

3. Your activity on the site

If you use the tools on the site, your score can grow. Watching money tips or using budget tools shows that you are learning.

4. Your credit history

The score also looks at your credit report. It checks:

- Your FICO score

- How much credit you use

- If you pay bills on time

5. Ratings from others

Some people on the platform leave reviews or trust ratings. These can help your score if others see you as reliable.

What makes this score different

Many credit scores update slowly. You may wait weeks to see a change. But the traceloans com score updates fast. Some users say it updates weekly or even faster.

It also gives clear advice. You can see why your score went up or down. That makes it easier to fix problems.

You get a free dashboard. You can:

- Check your score

- Track changes

- Read simple tips

- See what helps and what hurts

Why this score matters

Your score on traceloans com helps you get loans from lenders on the site. A higher score means you may get:

- Better interest rates

- Bigger loan offers

- Faster approval

It also helps you understand your money better. You see what you’re doing right. You see what you need to fix.

How to raise your traceloans com score

Here are steps that help:

Pay on time

Even one late payment can lower your score. Always pay loans or bills before the due date.

Use less of your credit

If you have credit cards, don’t use them all. Try to stay under 30 percent of your limit.

Avoid too many credit checks

Every time you apply for new credit, your score may dip. Only apply when needed.

Use different kinds of credit

It helps to show you can handle more than one type. That could be a credit card and a small loan, for example.

Take action on the site

Use tools, watch videos, and set goals. These all show you care about your finances.

What to keep in mind

You share data

To get your score, you need to link some accounts. This may include your bank, rent, or paycheck info. The site says it uses secure tools, but always make sure you feel safe.

It’s not a FICO score

Other lenders, like banks or mortgage firms, may not use this score. It works only on traceloans com.

Rules may change

The way they score you could change. They may adjust how they weigh things. If that happens, your score may move up or down even if you didn’t change your habits.

When this tool helps

traceloans com works well if:

- You are new to credit

- You have no bank loans

- You work freelance or get paid by apps

- You want to track your money habits

If you already have a strong credit score, you may get lower rates from a regular bank. But if you don’t, this tool gives you another path.

Read: MyWebInsurance.com Renters Insurance: A Simple Guide for Renters

Steps to get started

- Go to traceloans com

- Sign up for a free account

- Connect your accounts as needed

- Check your score

- Follow the tips on the dashboard

- Look at your loan offers

- Choose the best deal

Tips to stay safe

- Read every loan offer carefully

- Avoid short-term loans with very high fees

- Don’t borrow more than you can repay

- Keep your info private and don’t share your login

- Use the education tools on the site

FAQs

What is the traceloans com credit score?

It’s a score made by traceloans com. It checks how well you manage money. It updates often and helps you get loans through the site.

How can I check it?

Sign up on the site. It’s free. You can see your score anytime.

Does it hurt my credit?

No. Checking your score here does not affect your credit report.

Is it the same as a credit report?

No. It uses some of the same data, but it also looks at other things, like your rent and spending.

Can I raise my score fast?

Yes. If you pay on time and use the site tools, your score can go up quickly.

Do banks use this score?

No. This score is just for use on traceloans com. Banks use FICO or Vantage scores.

Final thoughts

The traceloans com credit score gives you a new way to see your money habits. It updates often. It uses your real life behavior. And it shows you how to do better.

If you want to borrow and grow your credit, this tool can help. Just make sure to read the fine print. Use it wisely. Stay in control of your money.