You pay many bills each month. These may include rent, water, gas, electricity, credit cards, or streaming services. It’s hard to keep up. Some bills are due on the first, others on the fifteenth. Some are fixed, others change. You might forget one and pay a fee. That costs money and causes stress.

Gomyfinance bills helps you keep things in one place. You see all your bills on one screen. You get alerts before due dates. You can even set up auto pay for bills that are always the same. You stay on time. You stay in control.

This tool helps you feel calm. You don’t have to check every account. You don’t have to guess what’s due next. You know what you paid and what you still owe.

What gomyfinance bills gives you

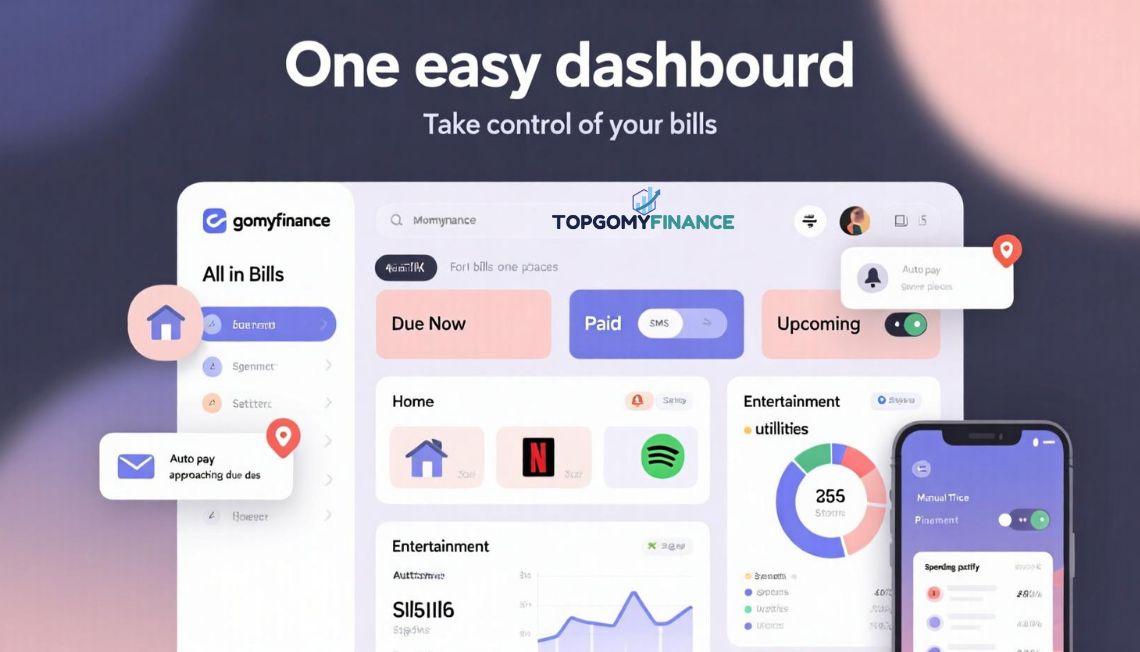

One easy dashboard

You can see all your bills in one place. The dashboard shows you what’s due, what you already paid, and what’s coming soon. You don’t need to jump between apps or logins. You can use it every day or every week to stay on track.

Reminders before due dates

You get alerts before each bill is due. These reminders can come by email or phone. You pick what works best. With reminders, you don’t forget. You don’t pay late fees.

Pay bills your way

You can pay bills yourself or set auto pay for bills that stay the same, like rent or your internet plan. You choose what to pay and when. That gives you more control.

Group your bills

You can group bills by type. For example, group rent and utilities under “home,” or group Netflix and Spotify under “entertainment.” This makes it easier to see where your money goes.

Helpful money insights

gomyfinance shows you simple facts about your money. You learn how much you spend on each type of bill. You see your monthly costs. You find bills you don’t use anymore. That helps you make better choices.

Easy to use on all devices

You can use gomyfinance on your phone or computer. It works on both. You don’t need special tools. Just log in and start tracking.

Safe and private

Your personal data stays safe. The app uses strong security to protect your info. Your passwords and account numbers are not shared. You stay in control of your money and privacy.

Why people use gomyfinance bills

You want to stay ahead. You want to stop forgetting payments. You want to see your bills in one place. You want to stop feeling behind.

This tool helps you feel in control. It saves you time. It lowers your stress. It helps you build better habits with money.

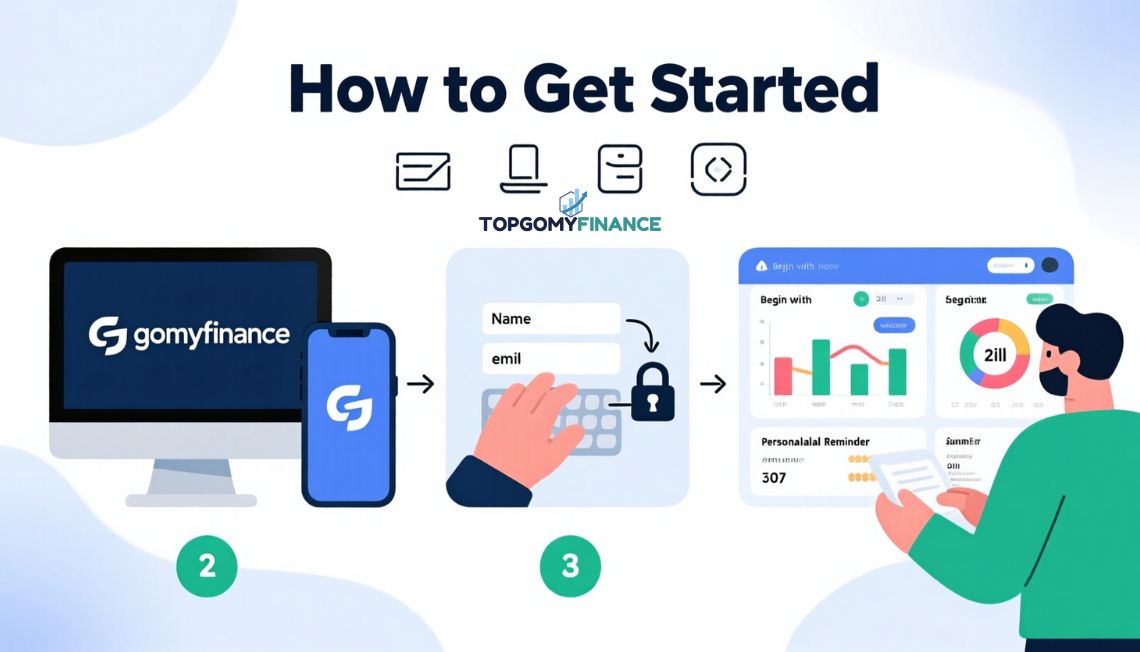

How to get started

You don’t need to be a tech expert. Anyone can use this. Here’s how to start:

- Go to the gomyfinance website or app

- Sign up with your name and email

- Add your bills or connect your accounts

- Pick reminder settings

- Start checking your dashboard

- Review your bills every week or month

That’s it. The more you use it, the easier it gets.

Tips to manage your bills better

Set reminders early

Get alerts a few days before the due date. That gives you time to move money or ask questions.

Group bills by type

Put similar bills together. It helps you see your biggest spending areas.

Check your monthly total

Know how much you spend on bills. It helps you plan your money.

Cancel unused bills

Look for services you don’t use anymore. Cancel them and save money.

Use auto pay for fixed bills

Auto pay is good for rent, subscriptions, or any bill that stays the same each month.

Pay variable bills yourself

Some bills change each month like your water or power. Paying these by hand lets you check the amount first.

Move due dates if needed

Some billers let you pick your due date. Try to set all bills close to payday. That way you always have money ready.

Read: Gomyfinance.com Invest Review: Smart Steps to Secure Your Financial Future

Who should use gomyfinance bills

This tool helps many people:

- Students with rent and tuition

- Parents who pay for home, car, school, and more

- Workers with multiple accounts

- Small business owners who pay bills every week

- Anyone who feels tired from juggling bills

If you want simple tools to stay on top of your money, this helps.

Compare your life before and after

| Without gomyfinance bills | With gomyfinance bills |

|---|---|

| You forget due dates | You get reminders |

| You feel behind | You feel in control |

| You pay fees | You avoid fees |

| You check many apps | You check one place |

| You lose track | You stay organized |

FAQs

Is gomyfinance bills safe to use

Yes. It uses strong data protection. Your info stays private.

Does it cost money

There’s a free version. Some extra features may cost a small fee.

Can I use it for all types of bills

Yes. You can add rent, power, credit cards, streaming, loans, and more.

Can I use it on my phone

Yes. It works on phones, tablets, and computers.

Do I have to use auto pay

No. You can choose manual payments. Auto pay is optional.

Can I use it if I don’t live alone

Yes. You can track bills with roommates, family, or by yourself.

Can I move my due dates

Yes, if your bill company allows it. This helps you match bills to payday.

Final thoughts

Managing bills is hard when you do it all by hand. It’s easy to forget things. That costs time and money. gomyfinance bills helps you stay ahead. You get reminders. You see your bills on one screen. You learn more about your money.