You may have seen coyyn.com online. Maybe you got a text. Maybe a friend shared it. You want to know one thing: can you trust it?

Here is the truth.

coyyn.com is not a bank. It does not take deposits. It does not give loans. It is not backed by the FDIC. If you want to open a bank account, this site will not help you.

So what is it?

No clear answer exists. The site does not say what it does. It does not list services. It does not show who runs it.

That is a big red flag.

Real banks tell you what they offer. They list fees. They give phone numbers and addresses. They say how your money is safe.

coyyn.com does none of these things.

Do not give it your personal details.

What Does coyyn.com Claim to Do?

The coyyn.com website has almost no info. There are no product names. No account types. No help section.

You can’t find a privacy policy. You can’t see terms of use. There is no contact form. No email. No phone number.

This is not normal.

If a site wants you to trust it, it must be open. It must show proof it is real.

coyyn.com hides too much.

If you can’t see who owns the site or where it is based, stay away.

Could It Be Linked to a Real Bank?

Some apps are not banks but work with banks. For example, Cash App uses Lincoln Savings Bank to hold funds. It says this on its site.

coyyn.com does not name a partner bank.

No FDIC link. No bank name. No legal info.

Without this, you have no proof your money would be safe.

You must know who holds your cash. If they do not tell you, do not use the site.

Is coyyn.com Safe?

There is no sign it is safe.

Safe sites use strong locks on data. They use two step login. They get checked by security firms.

coyyn.com shows none of this.

No trust badges. No SSL proof. No reviews from real users.

Sites like Trustpilot or the App Store have no posts about coyyn.com. That means few people use it. Or worse, it is too new or fake to be reviewed.

Never put your ID, Social Security number, or bank login on a site like this.

Your data could be stolen or sold.

Why Are People Talking About It?

Some say coyyn.com is a new bank. Others say it pays cash for signing up. These claims are not true.

It is likely a scam trick.

Fake sites often use words like “banking” or “pay” to grab your eye. They look clean. They seem real. But they are not.

You might have clicked an ad that said “Get paid fast with coyyn.com.” That is not real.

No real bank pays you just for signing up.

High interest rates? Free money? These are traps.

Scammers use big promises to steal your info.

What If You Already Used coyyn.com?

If you gave it your email, phone, or ID, act now.

Change your passwords. Use new ones for all key accounts like email and banking.

Turn on two step login wherever you can. This adds a code step when you sign in.

Check your bank and credit card bills. Look for charges you did not make.

Get your credit report for free at annualcreditreport.com. Look for new accounts you did not open.

If you gave your Social Security number, go to identitytheft.gov. This is the U.S. site for fraud help. They will guide you.

You can also call one of the big credit bureaus—Equifax, Experian, or TransUnion. Ask to put a fraud alert on your file. They will warn lenders to check your ID before opening new accounts.

Time is key. The faster you act, the less harm you face.

How to Spot Fake Banking Sites

You can learn to avoid scams.

Check the web address. Real banks use simple names. Chase.com. WellsFargo.com. If the name has odd letters or numbers, it is likely fake.

Look for contact info. Real banks list a phone number and street address. If you can’t find this, do not trust the site.

Search for reviews. Type the site name and “scam” into Google. Read what others say.

Check for FDIC insurance. Most U.S. banks are FDIC insured. You can confirm this at fdic.gov.

Do not click links in texts or emails. Scammers send fake messages with bank logos. They want you to click and log in.

Always go to the bank site by typing the name yourself.

These steps take less than two minutes. They can save you from big loss.

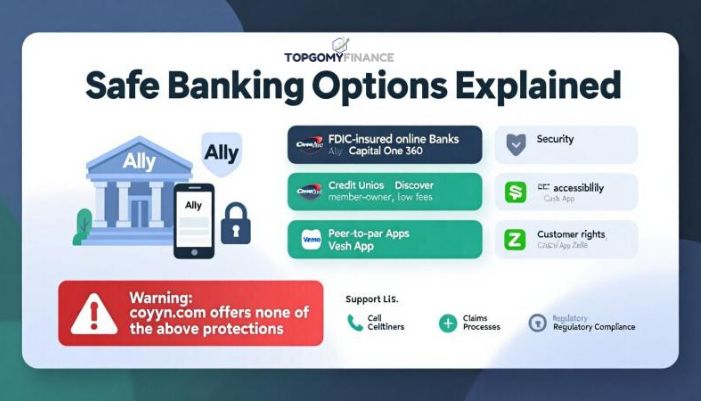

What Are Safe Banking Options?

Many real choices exist.

If you want online banking, try Ally Bank. Or Discover Bank. Or Capital One 360. These are real banks. They are FDIC insured. They pay interest. They have apps.

They let you deposit checks from your phone. Pay bills. Send money. All with strong security.

Credit unions are also good. They are member owned. Fees are low. Service is strong. Find one near you at yourcreditunion.org.

Apps like Venmo, Cash App, and Zelle are safe for sending cash to friends. They work with real banks. They use data locks.

These tools are not perfect. But they are open. They have support. They follow rules.

If a problem occurs, you can call for help. You can file a claim. You have rights.

With coyyn.com, you have none of that.

What If coyyn.com Contacts You?

You might get a text. An email. A call.

They might say “Your account is locked.” Or “Verify now or lose access.”

Do not reply.

Real banks never ask for your full Social Security number by text. They never ask for your password.

They do not call and say “Press 1 to fix your account.”

These are scams.

Delete the message. Do not click links. Do not call back.

If you are worried about your real bank, call them. Use the number on their official site or your card.

Never use a number from a suspicious message.

Read: Icryptoai.com Innovation: A Beginner-Friendly Guide to Smarter Crypto

Can You Report coyyn.com?

Yes.

Go to reportfraud.ftc.gov. File a report with the FTC.

You can also go to ic3.gov. This is the FBI’s site for online crime.

Tell them what happened. Add screenshots. List what info you shared.

Your report helps stop scams. It warns others. It aids law enforcement.

Even one report can make a difference.

Final Thoughts

coyyn.com is not a bank. It does not offer banking. It hides key facts.

You should not use it.

Your money and data are important. Use only trusted services.

Pick banks you know. Check their site. Read reviews. Make sure they are FDIC insured.

Take a few minutes to learn about a service. Do not rush.

A small delay can prevent big harm.

You do not need every new app. You need one that is safe, clear, and fair.

coyyn.com is not that.

Stay smart. Stay safe. Keep control of your money.

Frequently Asked Questions

Is coyyn.com a real bank?

No. It is not a bank. It does not have a license. It does not have FDIC insurance.

Can I open an account there?

No. The site does not let you open accounts. It does not offer banking services.

Is it safe to use?

No. It has no contact info, no privacy policy, and no proof of security.

Did I sign up by mistake?

You might have clicked a fake ad. If you gave info, change passwords and check your accounts.

Who owns coyyn.com?

The owner is not clear. No public name or address is listed. This is a warning sign.

Should I trust messages from coyyn.com?

No. Do not reply to texts or emails. They may be scams to steal your data.

Are there real services linked to it?

No known bank or app works with coyyn.com. No proof of real ties exists.

What should I do if I gave them my info?

Change passwords. Turn on two step login. Check your credit report. Report it at identitytheft.gov.

Can I get money back if scammed?

If you sent cash or shared bank details, call your bank fast. Report it to the FTC and local police.

What are better choices?

Use real online banks like Ally, Discover, or Capital One. They are safe, insured, and easy to use.