Money can feel hard to manage. Bills pile up. Spending happens fast. At the end of the month, you wonder where all your money went.

A budget helps fix that. It gives you a clear picture of your money. You know what comes in and what goes out. You can plan better and feel more in control.

GoMyFinance helps you build a budget that works for your life. This guide shows you how.

Why You Need a Budget

If you don’t track your money, it’s easy to lose it. A budget helps you:

- Spend less than you earn

- Save for things you want

- Pay off debt faster

- Avoid stress about money

With a budget, you know where every dollar goes. You don’t have to guess anymore.

What Is GoMyFinance?

GoMyFinance is an online tool. It helps you manage your money. You can track income, list expenses, set goals, and build a budget. You can use it on your computer or phone.

GoMyFinance is simple. You don’t need to be good at math. You don’t need to know finance terms. You just need to start.

Create Your Account

Go to the GoMyFinance website. Sign up with your email and a password. It only takes a few minutes.

Once you log in, you’ll see the main dashboard. It will guide you through the first steps:

- Add your income

- Add your expenses

- Link your bank (if you want automatic tracking)

You can also type in your income and expenses by hand. Do what feels easier for you.

Add All Income

You need to know how much money you make. Start by adding every income source. Be honest and exact.

Include:

- Your job pay

- Side job or freelance pay

- Child support

- Any money you get often

Look at your bank account to be sure. Don’t guess. This number matters.

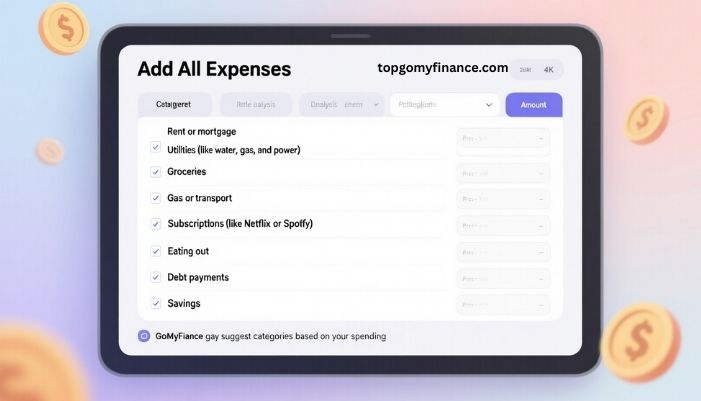

Add All Expenses

Now list what you spend. This part helps you see where your money goes.

Start with:

- Rent or mortgage

- Utilities (like water, gas, and power)

- Groceries

- Gas or transport

- Subscriptions (like Netflix or Spotify)

- Eating out

- Debt payments

- Savings

GoMyFinance may suggest categories based on your spending. You can also make your own.

Use your bank or credit card statements. Or let the app pull them in if you linked your accounts. Look at the last 30 days. You’ll learn a lot.

Create Your Budget

Now that you know your income and spending, it’s time to build a budget.

GoMyFinance shows:

- Your total income

- Your total expenses

- How much money is left

The goal is simple. Spend less than you earn.

Set a spending limit for each category. Here’s an example:

- Rent: 1000

- Groceries: 400

- Utilities: 150

- Gas: 100

- Eating out: 100

- Subscriptions: 50

- Debt: 300

- Savings: 300

That adds up to 2400. If you earn 2800, you have 400 left. You can save more or keep it for things that pop up.

Try to give every dollar a job. That helps you stay on track.

Set Money Goals

GoMyFinance lets you create clear goals. You choose what you want to do with your money.

You can:

- Save for a trip

- Pay off a credit card

- Build an emergency fund

- Buy a new phone or car

Set the goal amount and a deadline. The app shows how close you are. Watching your progress helps you stay focused.

Check and Update Weekly

Things change. You may earn more or less. You may get a new bill. That’s normal.

Log into GoMyFinance once a week. Check your budget:

- Are you spending too much in one area?

- Did you save what you planned?

- Can you adjust for next week?

Make small changes often. That works better than fixing big problems later.

Read: Gomyfinance Bills: The Easiest Way to Manage All Your Bills in One Place

Use the Reports

GoMyFinance shows simple reports. You don’t need to make charts. It shows:

- Where your money went

- How much you saved

- How much you spent

- If you met your goals

The reports are clear and easy to read. They help you make better choices.

Tips for Sticking to Your Budget

Budgeting works best when you keep it simple and honest. These tips help you stick with it:

1. Use Cash or Debit

Leave credit cards at home. You’ll spend less when you use only what you have.

2. Plan One Week at a Time

A whole month is hard to track. Break it into weeks. You’ll catch problems faster.

3. Save for Unexpected Costs

Set aside a little each month for surprise costs. That could be car repairs or a doctor visit.

4. Be Realistic

If you love coffee, don’t cut it out completely. Just give it a budget.

5. Celebrate Small Wins

Did you save this month? Did you pay off a credit card? That’s a win. Be proud.

Why Choose GoMyFinance?

GoMyFinance is built to be simple. Many other tools are too complex. This one keeps it clear.

Here’s why people like it:

- Quick setup

- Easy to use

- Works on all devices

- Tracks goals

- No confusing charts

- Manual or automatic entry

You stay in control. You don’t have to be a money expert. You just need to be consistent.

Budgeting Can Change Your Life

You don’t have to earn more to do better with money. You just need to know where your money goes. A good budget helps you do that.

With GoMyFinance, you can:

- Track spending

- Plan ahead

- Save for things you want

- Pay off debt faster

And it only takes a few minutes a week.

Final Thoughts

Money doesn’t have to feel hard. GoMyFinance makes it easier. You see what you earn. You track what you spend. You make better choices.

The best time to start a budget is today. Even a small step makes a big difference later.

You have the tools. You have the time. Now make the change.

FAQs

Is GoMyFinance free to use?

Yes. It has a free plan that works well. You can upgrade if you want more features.

Can I use GoMyFinance without linking my bank?

Yes. You can enter your income and spending by hand.

What if I don’t earn the same amount every month?

You can change your income anytime. GoMyFinance adjusts your budget.

Does it work on mobile?

Yes. You can use it on your phone or tablet. It also works on your computer.

How long does setup take?

Most people finish setup in 20 minutes or less.

Can I share my budget with my partner?

Yes. You can add someone to your account or export your budget.

Is my data safe?

Yes. GoMyFinance uses encryption and follows safe data rules. You stay in control.