When you apply for a loan, you want to know what is happening. traceloans shows you. It tells you where your loan is in the process. You see each step. You know what to do next.

You don’t have to call or guess. You get clear updates. traceloans keeps everything in one place.

How does traceloans work?

You log in. You add your loan. traceloans connects to your lender. It checks for updates. Then it shows you what’s going on.

Here’s how it looks:

- You send your loan application.

- traceloans shows “sent.”

- The lender checks your file.

- traceloans shows “in review.”

- The lender asks for more papers.

- traceloans tells you what you need.

- You send your papers.

- traceloans shows “received.”

- The lender approves your loan.

- traceloans says “approved.”

You can choose how you want updates. Use email, app alerts, or text.

What do you get with traceloans?

You get:

- A clear loan status page

- Fast alerts when things change

- Notes to remind you what to do

- A timeline so you know what’s next

- One place for all your loans

It saves time. It lowers stress. It helps you act fast.

Who should use traceloans?

If you buy a home

You follow many steps. You wait for checks, papers, and approval. traceloans tells you where you are.

If you refinance

You need to lock in a good rate. You don’t want delays. traceloans helps you move fast.

If you buy a car

You deal with banks or dealers. traceloans helps you track each one.

If you run a business

You may apply for more than one loan. traceloans helps you watch all of them.

What can traceloans help you avoid?

You won’t:

- Miss key deadlines

- Lose track of your papers

- Wait too long to reply

- Call five times for one update

- Feel lost in the process

traceloans gives you peace of mind. You stay ready. You act fast.

A simple example

You apply for a home loan. A week goes by. You don’t hear anything. You wonder what’s going on.

Without traceloans, you might wait or call. You might miss something.

With traceloans, you see “documents needed.” You get a reminder. You send the papers. Next, you see “review started.” You feel sure. You don’t guess. You stay on track.

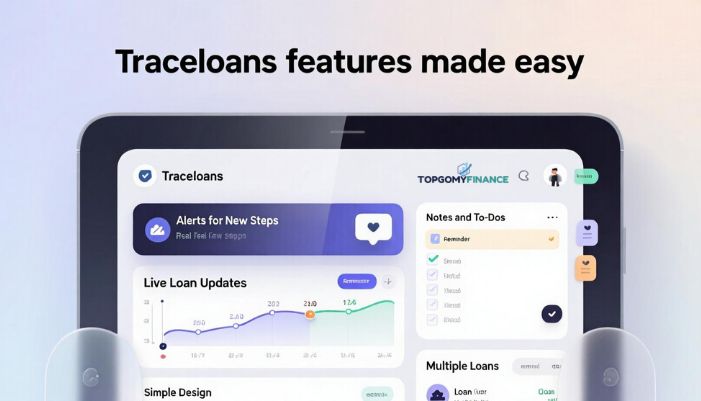

traceloans features made easy

Live loan updates

You see what is happening now.

Alerts for new steps

You know what to do next.

Notes and to-dos

You add reminders. You stay on time.

More than one loan

You check each loan in one place.

Simple design

You won’t feel lost or confused.

Why traceloans is useful

Loans take time. They have steps. You don’t always know what’s happening.

traceloans fixes that. It shows each step. It tells you what you need. It helps you move forward.

You save time. You feel calm. You stay ready.

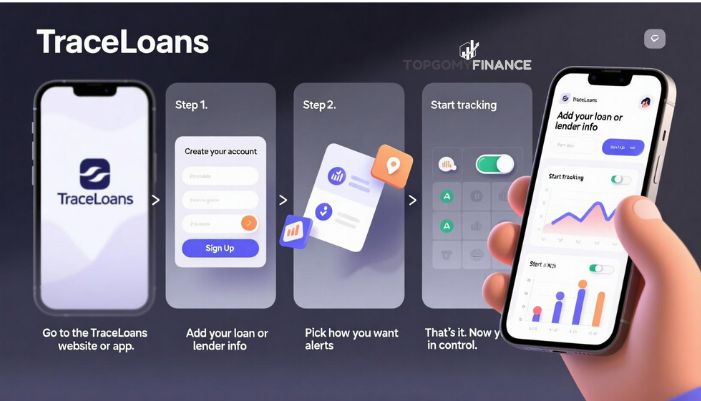

How to start using traceloans

- Go to the traceloans website or app.

- Create your account.

- Add your loan or lender info.

- Pick how you want alerts.

- Start tracking.

That’s it. Now you’re in control.

What makes traceloans better than waiting?

Other people wait for emails. Or they call and wait on hold. They may forget to send something.

You won’t.

traceloans shows you what’s next. It helps you reply fast. It keeps things clear.

Read: Ftasiafinance Business Trends from FintechAsia: Easy Guide for Business

How traceloans saves you stress

You know what’s happening. You don’t have to ask. You don’t worry about what you missed. You don’t dig through old emails.

You feel sure. You stay calm. You keep moving.

What people like about traceloans

- “I stopped calling my bank every day.”

- “I knew what papers I had to send.”

- “I saw each step as it happened.”

- “I closed on time.”

It works. It helps. It’s easy.

FAQs

What does traceloans track?

It tracks where your loan is right now. It shows steps like review, approval, and funding.

How often does it update?

Every few hours. It checks with your lender or portal.

Is it safe to use?

Yes. traceloans uses secure systems. You choose what to share.

Can I add more than one loan?

Yes. You can track many loans at once.

Is there a cost?

Some parts are free. Some plans may cost money. Check the website for prices.

Do I still talk to my lender?

Yes. traceloans helps you see updates. Your lender still handles the loan.

Conclusion

Applying for a loan is hard enough. Waiting for updates makes it worse. traceloans changes that. It shows you where your loan stands, what to do next, and how close you are to approval. You don’t need to call your lender or guess what’s happening. You see real-time updates, stay on schedule, and avoid delays.

Whether you’re buying a home, refinancing, or getting a car loan, traceloans keeps you in control. It’s simple, clear, and easy to use.

If you want less stress and more clarity during the loan process, traceloans is the tool to use.