If you’re thinking about buying a car and need a loan, you may have heard of Traceloans.com. But how exactly can it help you? In this guide, we’ll explain everything about Traceloans.com auto loans. From how it works to the loan types available, we’ll cover all the details you need to make an informed decision.

What Is Traceloans.com?

Traceloans.com is an online platform that helps you find auto loans. It connects you with a network of lenders, making it easier to get financing for your new or used car. Whether you want to buy a car now or refinance an existing loan, Traceloans.com can help you get a good deal.

Why Should You Use Traceloans.com?

There are many reasons why you might want to choose Traceloans.com for your next auto loan. Let’s go over the biggest benefits.

1. Lots of Lenders to Choose From

Traceloans.com works with many lenders, which means you have more options when it comes to finding a loan that fits your needs. You can compare offers and choose the one that works best for you.

2. Low Interest Rates

Traceloans.com helps you find competitive interest rates. Your rates will depend on things like your credit score, but they always work to give you the best possible offer.

3. Fast and Easy Application

Applying for a loan is simple and quick. You can fill out the online form in minutes and get responses from lenders within hours. No need to wait around or visit banks in person.

4. Flexible Loan Terms

You can choose the length of your loan to fit your budget. Whether you need a short-term loan or a longer one, Traceloans.com offers flexible terms to help you manage your payments.

5. No Penalties for Paying Early

Some loans charge a fee if you pay them off early. But with Traceloans.com, you don’t have to worry about that. You can pay off your loan ahead of time without any extra costs.

How Does Traceloans.com Work?

Getting an auto loan through Traceloans.com is easy. Here’s how it works:

Step 1: Complete the Online Application

Start by filling out an online application form. You’ll need to give some basic information, like your name, address, income, and the car you want to buy. It only takes a few minutes.

Step 2: Get Pre-Qualified

Once you apply, Traceloans.com will match you with lenders who can offer you a loan. This process won’t affect your credit score, so you can check your options without any worries.

Step 3: Review Your Loan Offers

You’ll receive loan offers from different lenders. Each offer will show you the interest rate, loan term, and monthly payments. Take your time to compare them and choose the one that works best for you.

Step 4: Pick Your Lender

After reviewing the offers, pick the lender that suits your needs. Once you choose, you’ll finalize the loan details, and the lender will send the money directly to the car dealership or seller.

Step 5: Drive Your New Car

Once the loan is approved, you’ll be able to pick up your new or used car and drive away.

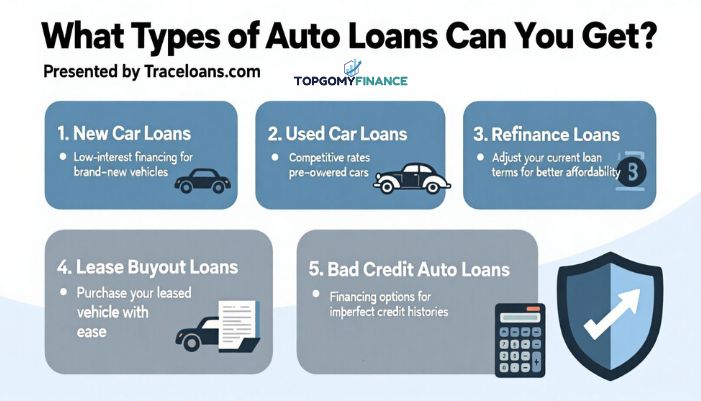

What Types of Auto Loans Can You Get?

Traceloans.com offers several types of auto loans, each suited to different situations. Here’s a look at the main options:

1. New Car Loans

If you’re buying a new car, Traceloans.com helps you find a loan with good terms. These loans usually come with lower interest rates compared to used car loans.

2. Used Car Loans

If you want to buy a used car, Traceloans.com can help you find a loan that works for you. These loans tend to have slightly higher interest rates, but Traceloans.com offers competitive options.

3. Refinance Loans

If you already have a car loan but want a better deal, you can refinance through Traceloans.com. Refinancing lets you adjust your loan terms, such as your interest rate and monthly payment, to make it more manageable.

4. Lease Buyout Loans

Have a lease on a car but want to buy it? Traceloans.com can help with a lease buyout loan. This type of loan lets you purchase the car at the end of your lease term.

5. Bad Credit Auto Loans

Even if you have bad credit, Traceloans.com can help. They work with lenders who specialize in loans for people with poor credit. You might get higher interest rates, but it’s still a way to get financing.

Read: Traceloans.com Credit Score: Raise Your Score and Get Better Loan Offers

What Do You Need to Apply for an Auto Loan?

Before you apply for a loan, there are a few things you’ll need. These are the basic requirements:

- Age: You must be at least 18 years old.

- U.S. Citizen or Resident: You need to be a U.S. citizen or a legal resident.

- Income: Lenders want to know that you can repay the loan. Having a steady income helps.

- Credit Score: While you don’t need perfect credit, a higher credit score will give you better loan terms.

- Driver’s License: Lenders usually require a valid driver’s license.

How Can You Improve Your Chances of Getting Approved?

There are a few steps you can take to improve your chances of getting approved for a loan through Traceloans.com:

- Check Your Credit: Make sure your credit report is accurate. Fix any errors before you apply.

- Pay Off Some Debt: If you have credit card balances or other debt, try to pay it down. This will lower your debt-to-income ratio and make you a more attractive borrower.

- Save for a Down Payment: A larger down payment can increase your chances of approval and may help lower your interest rate.

- Get Pre-Qualified: It’s a good idea to apply for pre-qualification. This will give you an idea of the loan amount and terms you can expect.

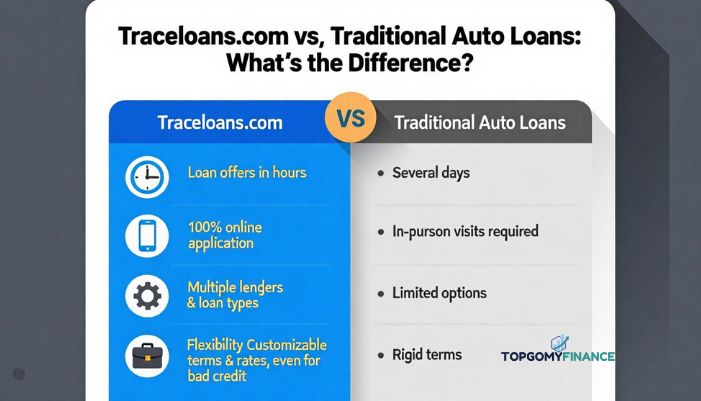

Traceloans.com vs. Traditional Auto Loans: What’s the Difference?

Here’s how Traceloans.com stacks up against traditional auto loans:

Speed

The process at Traceloans.com is fast. You can get loan offers within hours, while traditional banks or dealerships may take several days.

Convenience

You can apply online at Traceloans.com from anywhere. Traditional banks or car dealerships often require you to visit in person.

Variety

Traceloans.com offers a variety of loan types and lenders to choose from, while traditional lenders might offer fewer options.

Flexibility

Traceloans.com gives you more flexibility in terms of choosing lenders, loan terms, and interest rates, especially if you have bad credit.

Frequently Asked Questions (FAQs)

1. Is Traceloans.com Reliable?

Yes, Traceloans.com is a trusted service. It connects you with well-established lenders, making it safe and secure to use.

2. How Long Does It Take to Get Approved?

The approval process is quick. You can receive loan offers within a few hours of applying.

3. Can I Get a Loan with Bad Credit?

Yes, Traceloans.com works with lenders who offer loans to people with bad credit. You may have higher interest rates, but you can still get financing.

4. Can I Refinance My Auto Loan Through Traceloans.com?

Yes, Traceloans.com offers refinancing options. You can adjust your loan terms to get a better deal.

5. Do I Need a Down Payment?

You don’t always need a down payment, but having one can improve your loan terms and make it easier to get approved.

Conclusion

In summary, Traceloans.com is a convenient and reliable platform for securing an auto loan. Whether you’re purchasing a new or used car, refinancing an existing loan, or looking for a loan with bad credit, Traceloans.com offers a range of options that can fit your needs. The simple application process, access to multiple lenders, competitive interest rates, and flexible loan terms make it easier for you to get the financing you need. By using Traceloans.com, you can save time, compare offers, and drive away with confidence in your new car.