Paying for college can be tough. Many students rely on student loans to cover tuition and other costs. If you’re wondering about the best way to finance your education, Traceloans.com is one option to consider. In this guide, we’ll explain how Traceloans.com works, the types of loans available, and how to find the right loan for you.

What is Traceloans.com?

Traceloans.com is an online platform that helps you find the right student loans for your needs. Instead of dealing with just one bank or lender, Traceloans.com lets you compare different loan offers all in one place. This makes it easier for you to find the loan that works best for your budget.

The platform connects you with both federal and private lenders, which can help you pay for college. Whether you’re a high school senior, a current college student, or even a graduate, Traceloans.com offers a simple way to explore your loan options.

How Does Traceloans.com Work?

Traceloans.com is easy to use. Here’s a simple step-by-step guide on how the process works:

- Complete the Application: You fill out a short online form with your personal, educational, and financial information. It’s quick and simple to do.

- Get Loan Offers: After submitting your application, Traceloans.com will show you loan offers from different lenders. You’ll see important details like interest rates, loan amounts, and repayment plans, so you can make an informed decision.

- Choose the Best Loan: You compare the offers you received and pick the one that fits your needs. Whether it’s a federal loan or a private loan, you can select what works best for you.

- Finalize the Loan: Once you’ve selected your loan, Traceloans.com will help you complete the process. The loan money will be sent directly to your school to cover your tuition and other costs.

Types of Loans Offered by Traceloans.com

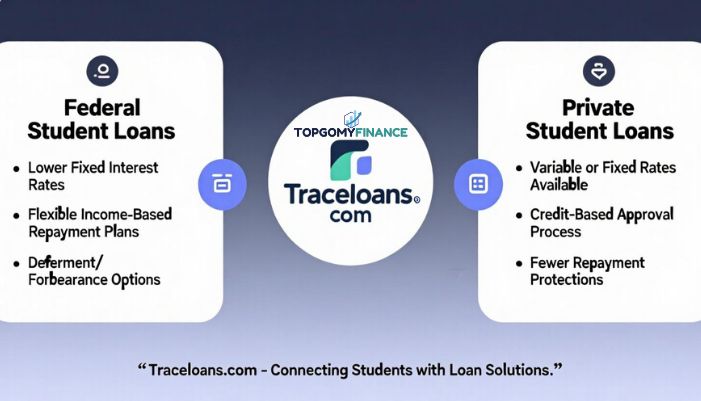

Traceloans.com connects you with both federal and private student loans. Let’s go over what each one offers.

Federal Student Loans

Federal student loans are loans provided by the government. They come with many benefits, such as lower interest rates and flexible repayment options. These loans also have certain protections, such as options to pause your payments if you experience financial difficulty.

Benefits of Federal Loans:

- Lower Interest Rates: The interest rate is set by the government, so it stays the same throughout the life of the loan.

- Flexible Repayment Plans: You can choose a repayment plan based on your income or financial situation.

- Protection: Federal loans offer options like deferment or forbearance if you can’t pay right away.

However, federal loans may not cover all of your education costs, which is where private loans come into play.

Private Student Loans

Private student loans are loans offered by banks, credit unions, or other private lenders. These loans are not funded by the government, so they can come with different terms. Private loans can help cover costs not met by federal loans.

Things to Keep in Mind About Private Loans:

- Variable Interest Rates: Some private loans have interest rates that can change over time.

- Higher Interest Rates: Private loans may have higher rates than federal loans, depending on your credit score.

- Fewer Protections: Unlike federal loans, private loans may not offer repayment plans based on your income.

Private loans are often necessary if you need to borrow more than what federal loans can cover.

Who Can Get a Loan from Traceloans.com?

Eligibility for loans through Traceloans.com depends on whether you’re applying for federal or private loans.

Federal Loans

To get a federal student loan, you must meet a few basic requirements:

- You must be a U.S. citizen or eligible noncitizen.

- You must be enrolled in a degree or certificate program at an eligible school.

- You must complete the Free Application for Federal Student Aid (FAFSA) to determine your financial need.

Private Loans

Private loans are based on your credit score and financial situation. Lenders typically look at:

- Your Credit Score: If you have a good credit score, you’re more likely to get a loan with a lower interest rate.

- Your Income: Lenders want to know that you can afford to repay the loan.

- Cosigner: If you have little to no credit history, you may need a cosigner to improve your chances of approval.

Read: Traceloans.com Auto Loans: Your Fast Track to Affordable Car Financing

How to Pick the Right Loan for You

Choosing the right student loan depends on several factors, like your financial situation, school costs, and future career plans. Here are a few things to consider when choosing a loan:

- What’s My Credit Score? If you have a high credit score, private loans might offer better rates. If not, federal loans may be the better choice.

- How Much Do I Need to Borrow? If you only need to borrow a small amount, federal loans might be enough. If you need more, private loans may cover the difference.

- What Are the Repayment Terms? Look at the interest rates, repayment plans, and any protections the loan offers. Federal loans usually have more flexible repayment options.

- Can I Afford the Payments? Make sure you can afford the monthly payments, both during school and after graduation.

Repayment Options for Traceloans.com Loans

Once you finish school or drop below half-time enrollment, you’ll need to start repaying your loan. Here’s a breakdown of repayment options for both federal and private loans:

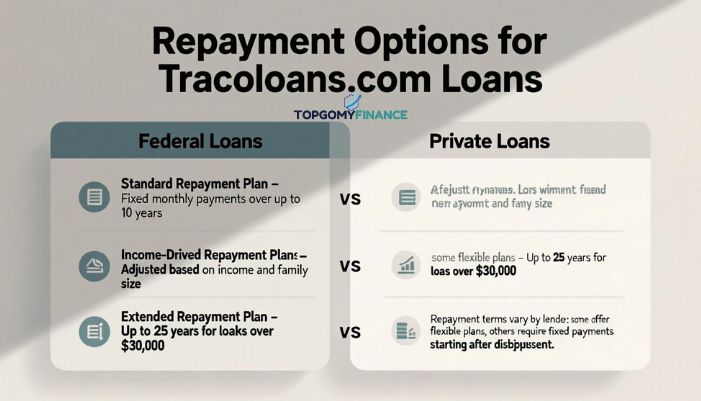

Federal Loan Repayment

Federal loans offer different repayment plans, including:

- Standard Repayment Plan: You pay the same amount every month for up to 10 years.

- Income-Driven Repayment Plans: Your monthly payment is based on how much you earn and your family size.

- Extended Repayment Plan: For loans over $30,000, you may be able to extend your payments up to 25 years.

Private Loan Repayment

Private loan repayment depends on the lender. Some lenders offer flexible repayment plans, while others may require fixed payments right after the loan is disbursed. Be sure to check the specific terms with your lender.

Pros and Cons of Traceloans.com

Before you decide, it’s important to weigh the pros and cons of using Traceloans.com.

Pros

- Convenience: You can compare multiple loan offers in one place.

- Competitive Rates: The platform helps you find loans with the best rates.

- Both Federal and Private Loans: You can explore both types of loans in one place.

Cons

- No Direct Loans: Traceloans.com doesn’t offer loans directly. It’s a marketplace.

- Limited to Partner Lenders: You’ll only see offers from lenders in Traceloans.com’s network.

Conclusion

Traceloans.com is a helpful tool for students who want to compare different loan options. It’s especially useful if you need both federal and private loans, or if you want to avoid going to several different lenders. However, be sure to read all the terms and conditions before you accept any loan offer.

FAQs

1. Is Traceloans.com free to use?

Yes, using Traceloans.com to compare student loans is free.

2. Can I apply for both federal and private loans on Traceloans.com?

Yes, you can explore both types of loans through the platform.

3. How do I apply for a student loan on Traceloans.com?

Just fill out a simple online application to get started.

4. Does Traceloans.com offer loan forgiveness programs?

No, Traceloans.com itself does not offer loan forgiveness. However, federal loans may be eligible for forgiveness programs.

5. What if I can’t pay back my loan?

If you have trouble making payments, reach out to your lender right away to discuss options like deferment, forbearance, or income-based repayment plans.